Blockchain App Development Cost: How CapEx and OpEx evolved in the last eight years

)

The blockchain industry has gone through a rollercoaster of changes over the years. From being a buzzword used everywhere in 2018 to the VC craze and the first major crypto bull run in 2021, and finally to real-world blockchain use cases and enterprise adoption in 2024.

New protocols, platforms, and tools along with fluctuating market interest and external cost factors have significantly influenced the blockchain app development cost.

To understand these shifts, we conducted research on how blockchain development CapEx (capital expenditures) and OpEx (operating expenditures) have evolved over the past eight years. In this article, we explain how these costs have changed, identify the key cost drivers for blockchain applications in 2025, and explore how budgets are likely to be allocated across different cost centers.

Defining Blockchain CapEx and OpEx

In our research, we grouped all cost centers into two main groups: Capital Expenditures (CapEx) and Operational Expenditures (OpEx).

While this cost breakdown is standard for traditional IT projects, blockchain introduces unique financial considerations due to factors such as decentralized networks, consensus mechanisms, and continuous protocol evolution.

Capital Expenditures

In blockchain app development, CapEx refers to large upfront, one-time investments preceding app deployment. This typically includes:

- Initial development and integration: architecting the system, smart contract development, front-end design, third-party integration.

- Infrastructure development: on-premise hardware set up.

- Security auditing and compliance: contracting third-party vendors for smart contract audit.

These upfront expenditures lay the technical and security foundation of the blockchain solution.

Operational Expenditures

Once the blockchain is deployed, OpEx covers the ongoing maintenance and update costs. Common OpEx costs include:

- Cloud infrastructure and node management: Cloud-based infrastructure solutions, such as Amazon Managed Blockchain or Google’s Blockchain Node Engine.

- Gas (transaction) fees: Transaction costs for operations on public blockchains like Ethereum.

- Ongoing Maintenance: Security patches, additional security audits, updates to comply with changing regulatory landscape.

- Staffing and user support: Salaries for engineers and technical support specialists that will handle post-launch troubleshooting and optimization.

External Factors Influencing App Development Price Trends

External climate also plays a significant role in blockchain app development cost trends. To fully understand how and why prices have changed, we will outline external factors before diving into main cost centers.

Inflation

Unstable macroeconomic environment and geopolitical tensions have driven global inflation rates higher, impacting costs across industries—including Web3 and crypto.

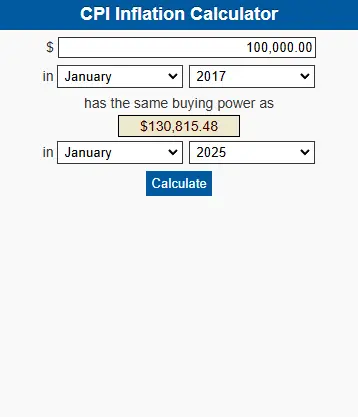

Between 2017 and 2025, cumulative inflation has reached approximately 30.8%, affecting every aspect of blockchain app development. Key cost drivers such as developer salaries, third-party services, smart contract audits, cloud infrastructure, and hardware have all become significantly more expensive.

For example, a blockchain developer earning $80,000 annually in 2017, now charges around $104,000. For a core team of five, total payroll increased from $400,000 to $520,000. Infrastructure expenses, security audits, and cloud services follow a similar trajectory.

Basically, launching a Web3 project in 2025 costs at least 30% more than it did in 2017—purely due to inflationary pressures.

VC focus shift

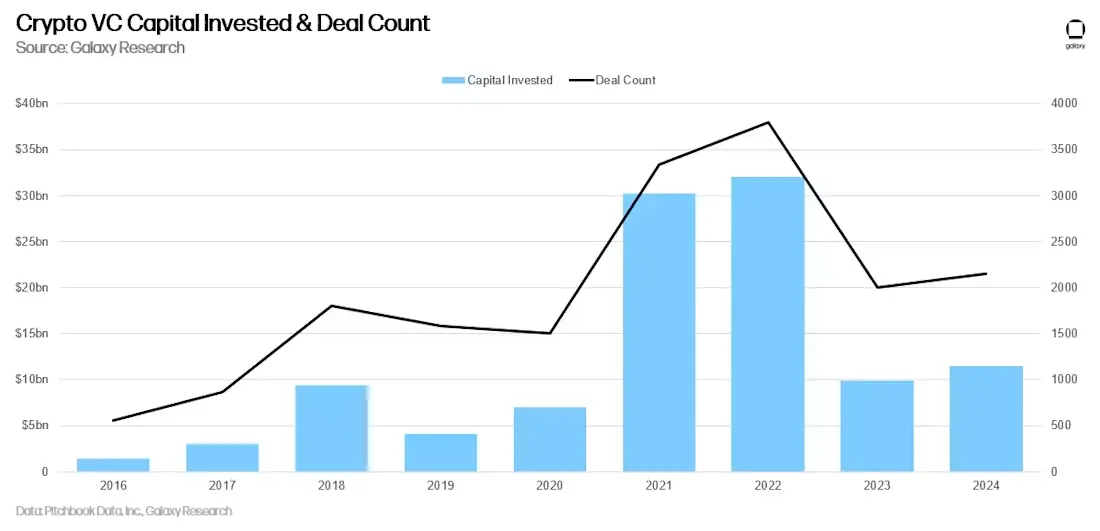

Over the past eight years, VC funding has experienced significant fluctuations.

According to the latest Crypto & Blockchain Venture Capital Report, total crypto VC investment stood at approximately $2.5 billion in 2017. The market peaked in 2022, reaching an all-time high of $32 billion in funding.

What about 2025? VC funding has declined significantly—down nearly threefold—now totaling around $12 billion.

How did this influence project costs? On one hand, reduced VC funding has slightly eased competition for talent. In bullish funding cycles, companies aggressively compete for top blockchain developers, driving up salaries and contract rates. With fewer VC-backed startups, this pressure has lessened somewhat, leading to marginal hiring cost reductions.

On the other hand, tighter funding has led to fewer developers entering the blockchain space, worsening the industry-wide talent shortage—an issue we’ll explore later in the article.

Besides, investors are now less inclined to fund foundational infrastructure projects. A breakdown of VC capital distribution shows that Infrastructure, Layer 1, and Layer 2 solutions collectively account for just 23% of total funding.

With lower capital inflows and reduced focus on infrastructure, founders must take a more hands-on approach—innovating, building, or maintaining critical components in-house. This ultimately drives up both CapEx and OpEx.

Regulatory Landscape

The blockchain and crypto regulatory landscape has changed drastically, from heaving minimal guidance to a complex puzzle of national and international rules.

In 2017, a whitepaper was enough to launch the product. The U.S. refused to “poke the bear” at that time, and their only concern was how people were reporting their income and how they’re taxed.

At that time, Europe was more conscious about crypto, designing laws to encourage growth of the technology.

In Asia, Japan was the first country to recognise crypto as “legal means of payment”, but not as a traditional currency. Banks weren’t able to offer their customers Bitcoin but neither was it unlawful to hold bitcoins, leaving the sector to be driven by fintech innovators exclusively.

Compliance costs were almost nonexistent—many teams never hired dedicated legal counsel, and audits were optional rather than mandatory.

Fast forward to 2025:

Companies planning to launch exchanges or tokens in major markets face licensing from multiple regulators (e.g., the SEC in the U.S., MAS in Singapore, FCA in the U.K.). The legal and filing fees alone can push a project’s CapEx beyond initial projections.

AML/KYC

Since 2020, AML/KYC regulations have significantly expanded. In 2023, the Digital Asset Anti-Money Laundering Act was introduced in the U.S., requiring individuals and businesses to report crypto transactions exceeding $10,000.

Canada has been more proactive in implementing AML measures. Since 2020, businesses dealing in virtual assets must register with the Financial Transactions and Reports Analysis Centre of Canada and report transactions over CAD 10,000.

Evolving compliance requirements introduce substantial costs for blockchain startups. AML efforts increase CapEx for initial legal consulting and compliance setup, while OpEx grow due to ongoing regulatory monitoring and product adjustments. Notably, in 2017, AML/KYC compliance costs were almost negligible.

Smart Contracts In 2023, the European Union introduced extensive regulations for smart contracts under Regulation 2023/2854. The framework mandates that companies using smart contracts for user-facing services must:

- Ensure compliance with "essential requirements"—including security, reliability, and the ability for smart contracts to be interrupted or terminated.

- Undergo a conformity assessment conducted by an accredited certification firm.

- Issue an EU declaration of conformity to verify regulatory compliance.

One of the most critical aspects for Web3 founders operating in the EU is the ‘kill switch’ requirement for smart contracts—despite being immutable by design. This regulation introduces significant complexity in smart contract architecture, forcing developers to rethink fundamental design principles.

The European Commission launched the European Blockchain Sandbox, a unique initiative aimed to increase legal certainty for innovative blockchain technology solutions.

From a cost perspective, these regulations substantially stretch development timelines, as they often require novel technical solutions. Compliance costs surge as well. Companies must now engage accredited third-party firms for smart contract security audits and regulatory validation, leading to unprecedented upfront costs compared to pre-2020 levels.

Bottom line: In just eight years, the crypto wild west has evolved into a stringent set of regulations spanning licensing, AML/KYC obligations, and mandatory kill-switch functionalities for smart contracts. The explosion of regulations—especially in the EU and other major markets—forces projects to allocate significantly more resources to compliance.

Blockchain App Development Cost: Identifying Key Cost Centers

To understand the primary cost centers of blockchain app development eight years ago, we need to look back at the landscape of that time.

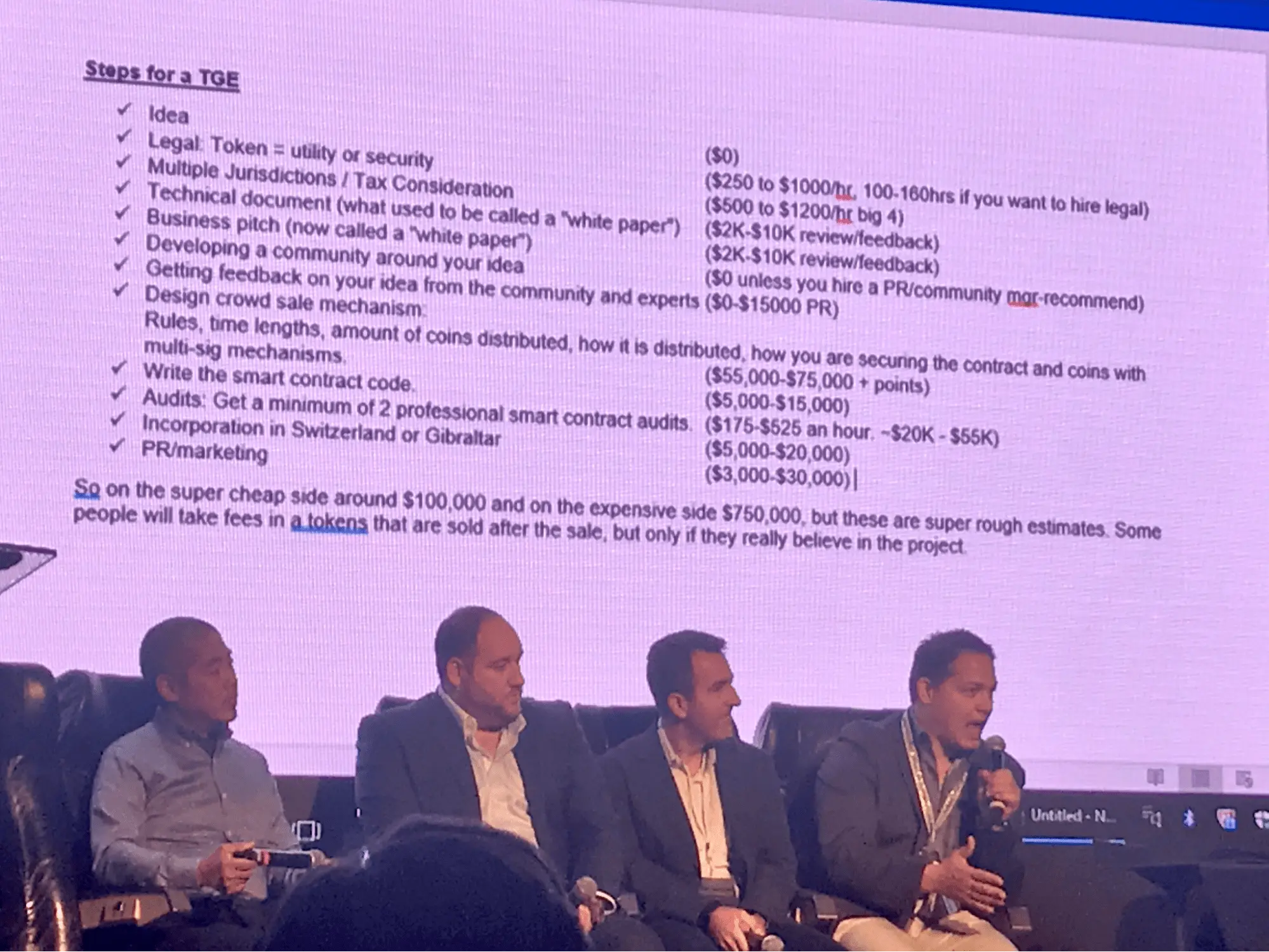

At BlockCon 2017, industry experts from various sectors gathered to discuss the key components of the blockchain startup team and the potential cost of the project.

While developers and a marketing team were essential for a Token Generation Event (TGE), it was surprising—even then—how much legal, tax, and compliance considerations impacted project budgets.

Speakers at the event agreed that launching an TGE-level project costs anywhere between $100,000 and $750,000 (by very rough estimates). What were the primary cost centres?

- Legal: 100-160 hours, with an hourly rate between $250 - $1,000.

- Tax considerations: $500 - $1,200 / hour, when hiring tax specialists from the big four.

- Whitepaper: $2,000 - $10,000 for a document review

- Business pitch: $2,000 - $10,000 for a pitch review

- Community management: $0. Hiring a PR specialist / community manager is recommended, around $80,000 / year

- Tokenomics development: $55,000 - $75,000

- Getting feedback from the community: $0 - $15,000

- Smart contract development: $5,000 - $15,000

- Smart contract audit: $175 - $525 / hour, ~$20,000 - $55,000

- Incorporation: $5,000 - $20,000

- PR/marketing - $3,000 - $30,000

These estimates should be taken a grain of salt, as even the speakers acknowledged that budgets vary greatly from project to project. They also emphasized the critical role of the founder’s technical expertise. If the founder doesn’t have any, they must hire additional developers, further increasing the costs of smart contract development and tokenomics design.

How the blockchain app development costs have changed in 2025 and what are the key cost drivers today? Let’s find out.

Blockchain developer shortage: CapEx ⏫, OpEx ⏫

The 2024 Crypto Developer Report shows that the number of new developers entering the blockchain space has declined by approximately 55% since 2022. This makes recruiting, hiring, and retaining talent harder.

Web3 and smart contract developers were a rarity even before this downturn, but the shortage has now intensified. This is further evidenced by web3.career salary data, which shows that blockchain developers with at least two years of experience earn **50% more ** than developers specializing in conventional tech stacks.

If the trend continues, we should expect blockchain developers to charge even more, because the talent supply isn’t matching demand, especially considering the latest wave of hype across web3 and crypto. Fierce competition for blockchain talent will continue to drive salaries higher, while recruiting costs rise due to the limited talent pool.

In-house development team expenses: OpEx ⏫

Tom Dunleavy, Partner at MV Global, a venture capital investment firm, recently shared a hot take that—crypto startups don’t need to raise over $10 million in funding.

His argument? Crypto startups receiving $10M+ checks are securing a runway of 5+ years, which negatively impacts team motivation to innovate and grow the company.

But is that really the case?

Stacy Muur, author of Stacy in Dataland, a newsletter covering Web3 trends, provided a cost breakdown of maintaining an in-house blockchain development team:

What does $10M actually mean? Team: • A team of 5 devs → ~$450K on salaries / year (very good devs!) • Marketing + community team → ~$200K on salaries / year • Other intel guys (ops, legal, etc) → $150K on salaries / year

Marketing: • KOLs → $1.8M / year (the budget needed to make every CT KOL who accepts sponsorships speak about you) • Plus some budget to experiment with other types of ads → $200K / year

Ops: • Bootstrapping liquidity → $500K (one-time) • Ops expenses (infra, etc) → $100K / year (imagine you have to pay a lot)

Result: $2.9M of peak marketing monthly spend Runway: 3+ years

According to Stacy’s estimates, the average annual salary of a western blockchain developer is $90,000.

However, our own research suggests these numbers are slightly underestimated. According to web3.career, the average salary of a crypto developer is closer to $150,000 / per year.

Based on ITJobsWatch data, we can see that blockchain developers’ salary in the UK has doubled since, from $88,500 in 2017 up to around $150,000 in 2024.

That brings the cost of maintaining a team of five up to $750,000 / year. If you have something more complex and need more developers, the number can easily cross $1 million / year.

Marketing expenses also make up a significant portion of total project costs. Hiring community managers, paid ads specialists, sponsoring crypto influencers, and securing launchpad listings doesn’t come cheap.

The rise of layer 2 blockchains: CapEx ⏬, OpEx⏬

Layer-2 technology revolutionized the web3 niche and enabled a surge of new projects. Its cost efficiency compared with layer-1 was one of the primary cost saving drivers for decentralized projects since 2017.

Savings come from reduced gas fees for smart contract deployment and transactions.

In 2017, layer-2 technology was slowly gaining momentum, with Rootstock (RSK) and Lightning Network pioneering the space. At the time, most developers were building apps on Ethereum, struggling with high gas fees.

As of now, there’s a vast array of layer 2 solutions to choose from. But how much have they actually reduced fees?

Gas costs in 2017 (ETH) To estimate historical costs, we need gas prices from eight years ago. In 2017, the average gas price was 60 Gwei.

Smart contract deployment costs vary widely, but using a typical gas limit of 3,850,000 gas for a basic contract, the cost breakdown was:

Deployment: • Cost = 3.85M × 60 Gwei = 0.231 ETH • In USD (at $2,672/ETH): Approximately $617

That’s a hefty sum just to get your project live. But the expenses don’t stop there. Reserving NFTs for your team or promotional events adds more costs. Reserving 10 NFTs, for instance, uses 1.17 million gas (117,000 gas limit per NFT): • Cost = 1.17M × 60 Gwei = 0.0702 ETH • In USD: Around $187

For users, minting a single NFT isn’t cheap either. With 152,000 gas per mint: • Cost = 152,000 × 60 Gwei = 0.00912 ETH • In USD: About $25

If an NFT was priced at 0.01 ETH (~$43), they often paid as much in gas fees as for the NFT itself—a major adoption barrier.

How layer-2 changed costs The adoption of layer-2 solutions offered faster speeds and drastically lower costs, while still allowing assets to move between the two networks.

Let’s compare Ethereum's 2017 costs with Polygon (POL, formerly MATIC) with a gas price of around 80 Gwei and token price of $0.2815

Deploying a Smart Contract: • Gas: 3.85M • Cost = 3.85M × 80 Gwei = 0.308 POL • In USD: $0,08 • Savings: Nearly 7,156x cheaper than Ethereum’s $617.

Reserving 10 NFTs: • Gas: 1.17M • Cost = 1.17M × 80 Gwei = 0.0936 POL • In USD: $0.02 • Savings: Over 9,000x less than Ethereum’s $187.

NFT minting: Less than $0.01 per mint—practically free compared to Ethereum.

These massive cost reductions highlight the cost advantage of layer-2 chains. The rapid adoption of layer-2 solutions gave a jumpstart to lots of new projects and was one of the reasons for massive VC investments in 2021.

Infrastructure changes: CapEx ⏬, OpEx 🔼

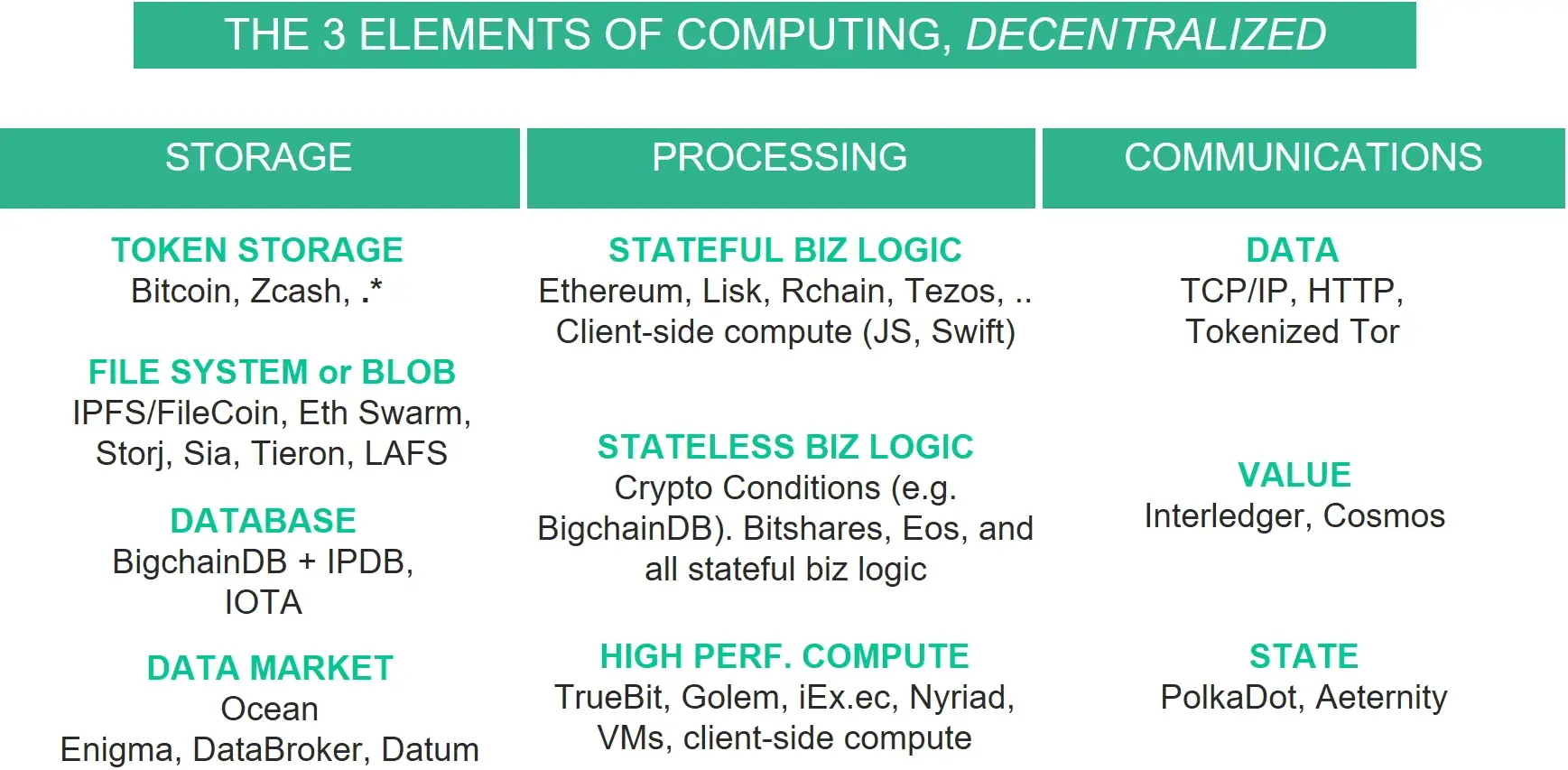

In 2017, Trent McConaghy, Founder at Ocean Protocol, published a detailed analysis of the blockchain architecture landscape. If summarized with one image, it would look like this:

The infrastructure was highly fractured, requiring a lot of pieces to function. This complexity drastically changed with the emergence of BaaS (Blockchain-as-a-Service) solutions.

By late 2018, Amazon launched its first version of Amazon Managed Blockchain (AMB). AMB simplified blockchain deployment and eliminated much of the infrastructure setup and maintenance burden.

Amazon’s service handles node deployment, security, scaling, and maintenance. It supports various use cases with both Hyperledger Fabric (allowing for private blockchains) and Ethereum (supports smart contracts and dApps).

AMB pricing

Amazon operates on a pay-as-you-go model, billed per second. The final price depends on:

• Type of membership • Node instance type • Peer node storage volume • The volume of data written to the blockchain network • The movement of any data to or from AMB

Cost breakdown example

For example, let’s consider an application that uses two c5.large Ethereum nodes in the US East (N. Virginia) region, each with 300 GB of storage, and handling 30 million requests per month:

• Peer Node Cost: 2 nodes × $0.136 per hour × 24 hours/day × 30 days = $195.84 • Storage Cost: 2 nodes × 300 GB × $0.10 per GB-month = $60 • Requests Cost: 30 million requests × $3 per million = $90

Total Monthly Cost: $195.84 (nodes) + $60 (storage) + $90 (requests) = $345.84

Clearly, costs scale with bandwidth and user volume—the more intensive the application, the higher the expenses.

BaaS solutions reduced the complexity of blockchain infrastructure, enabling teams to ship products faster and cut infrastructure costs. Platforms like Chainstack, Blockstream or Kumo further simplify integration by offering managed solutions for:

- Payment gateway integration

- Dedicated node setup

- API connectivity

However, running a small app is one thing, and running a blockchain is another.

How much does it cost to run a blockchain?

Andre Cronje, Co-Founder & Architect at SonicLabs, recently shared insights on the cost of developing a “semi-successful” layer-2 blockchain. Here’s where Andre’s budget went in 2024:

Since Joseph is a technical founder himself handling the project without a large dev team, smart contracts and front-end development fall on his shoulders. This allows him to keep development costs low.

A significant share of the budget goes to auditing, as security is crucial for DeFi protocols.

As for launch pads and liquidity providers bribes, the numbers may seem exaggerated, but it coincides with marketing costs from Stacy’s estimates. If you want a successful launch, prepare to spend a lot with launchpads and niche influencers.

As seen from Joseph’s example, it’s possible to bootstrap a project if you have technical expertise, time, and the willingness to commit full-time. However, if you work under strict deadlines, need to validate your project hypothesis fast, or search for product-market fit, having a dedicated team can be a better approach.

Bottom Line: How did the blockchain app development cost change?

Since the first crypto boom a lot of things have changed behind-the-scenes.

Even despite the emergence of layer-2 blockchains and BaaS products, the development cost of an IPO-ready product has grown during the last eight years.

Inflation and regulatory overhead are main cost drivers of new blockchain projects. In 2025, if you want to launch a DEX platform, engineering costs will be on the bottom of your expense list. Prepare to hire a lawyer and certified audit firms to ensure your smart contracts are secured.

Talent shortage is also a serious problem. Though blockchain and crypto is back on the hypertrain in 2025, it will take years for new developers to learn niche tech stacks and fill in the current talent gap. For now, the shortage inflates web3 developers’ salaries, further increasing the final cost of the project.

Finally, when aiming for an ICO, consider essential costs for partnerships with launch pads and crypto influencers. With the market overheated with memecoins and a vast range of layer-2 / 3 tokens, it’s vital to make people in the space discuss your token to get initial traction.

Cut Infrastructure Bills, Slash Dev Hours, Shrink Payroll — with Kumo

Blockchain projects no longer have to drain your budget or staff calendar. Enter Kumo, a blockchain transformation platform that cust development time and ifnrastructure costs at times.

Weeks of configuration, not months of coding Wallet abstraction, royalty logic, minting flows, and admin dashboards are pre-integrated. Your team customizes the UI and token rules instead of stitching together half a dozen open-source repos.

Use-case agnostic architecture Need to migrate your loyalty program on-chain? Launching an NFT marketplace for your gallery? Or, starting a fractional real-estate investment platform? Kumo is built to bring any conventional businesses and processes on-chain.

A crew to handle custom enhancements Have specific features in mind? Kumo developers can bring yur vision to life, helping you save hiring time and eliminate the payroll burden of a full blockchain engineering squad.

With Kumo you get less CapEx on infra, fewer billable dev hours, and lower OpEx for maintenance—so more of your budget powers growth, not plumbing. Contact us to discuss the details of your project!

)

)

)

)

)

)

)

)

)